Analysis of Chelsea's 2021 financial statement

Counting the costs and an elite story of risk-reward

Chelsea FC’s 2021 financial statements further illustrate the business model –frequent managerial turnover, sale of fringe players, and risk-loving attitude- that has delivered 19 trophies in the 18-year era of its owner, Roman Abramovich. Despite the 2021 continental success and its financial rewards, Chelsea is the first English club to hit £1bn in cumulative losses. The impact of the pandemic on Chelsea is minimal – compared with other Big-6 clubs in the EPL – because the club is less reliant on matchday revenue. Thomas Tuchel has performed well as Chelsea’s manager – winning the UCL within 6 months of his appointment. However, there is no room to rest on his laurels as the data shows that Roman tends to sack managers who are, on average, 13 points from the top of the EPL table. As of game week 21, Chelsea is 10 points behind Manchester City.

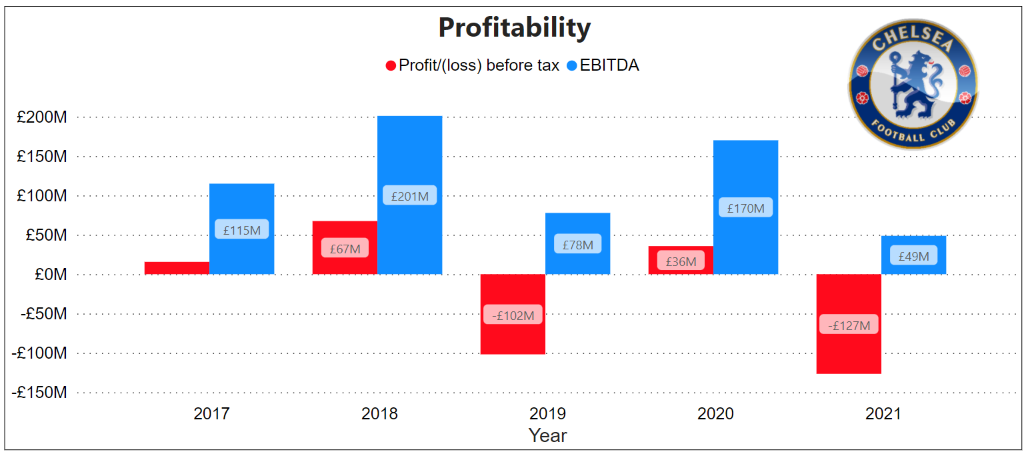

Profitability

Chelsea’s 2020 profit before tax of £36m was due to the transfer ban imposed by FIFA and the remarkable work of Chelsea’s transfer guru and Director, Maria Granovskaia. In 2021, the club’s quest for on-field success, coupled with the deflated transfer market due to the pandemic, led to the club reporting £127m pre-tax loss.

I expand on the factors that led to the 2021 loss below. However, it is worth noting here that Chelsea is the first EPL club (Or maybe the first in the world!) to report £1bn in losses in its retained earnings.

Annual profit or loss is “deposited” into a club’s (company’s) retained earnings, essentially making it a “bank” account of historical profitability. When Roman acquired Chelsea in 2003, retained earnings were -£54m. Today, it’s -£1.08bn. As such, It is not a coincidence that Chelsea owes its owner £1.5bn in loans (discussed further, below).

Revenue

Chelsea’s 2021 broadcast revenue was £274m, a 50% increase from 2020. The bulk of the growth is attributed to winning the UCL. At the same time, a small fraction of the increase is due to the 9 games of the 2019/2020 season played in July (therefore spilling into the 2021 financial year).

UEFA has yet to publish how much it distributed to clubs in 2021, but I estimate that Chelsea would receive north of £108m (Chelsea received £69m in 2020 for reaching the round of 16). My estimation is based on UEFA’s complex distribution model, which I detailed here.

Commercial and matchday revenue were the most impacted by the pandemic. With matches played behind closed doors for virtually all the 2020/2021 season games, matchday revenue fell by £46m to £7m in 2021. With the club reaching the UCL final, it is safe to say that the matchday revenue lost is more than £46m. Pre-season tours (usually abroad) are essential for building the playing squad’s fitness, but they are also integral to commercial revenue through merchandise sales and exclusive club events. Unfortunately, clubs could not organise pre-season tours for the 2020/2021 season, thus a drop in commercial revenue. Nevertheless, Chelsea’s relatively small stadium (42,000 seats) and a surprisingly low commercial focus means they aren’t top 3 matchday or commercial earners in the EPL.

Wages and salaries

“What goes up must come down.”

Obviously, Isaac Newton didn’t come across wages and salaries in football. After a brief dip in 2020 (FIFA ban induced), Chelsea’s 2021 wage bill again reached a record high at £333m (approximately £6.5m per week), a whooping £50m annual increase.

The club is now spending 77% of its revenue on paying its staff – both playing and backroom. Except Chelsea can somehow pull off another impressive UCL run, it is unlikely that the percentage will reduce in 2022. The wage of Chelsea’s only summer signing, Lukaku, is not included in the 2021 figures.

Maria Maria: The transfer genius

Will it be a complete analysis without a section dedicated to Maria Granovskaia? Nope!

The jury is still on whether Chelsea gets value for money on players bought. For example, less than 2 years after signing Kepa Arrizabalaga for £72m, Chelsea spent £22m on Edouard Mendy, his replacement as first-choice goalkeeper. In total, Chelsea spent £222.2m (136% increase from 2020) to acquire Kai Havertz, Ben Chilwell, Hakim Ziyech, and Mendy.

The fall in European transfers (from €6.5bn to €4bn in 2021) due to the pandemic is responsible for the sharp fall in Chelsea’s (from £190m to £31m in 2021) transfer fee receipts. Emphasis is on Europe, excluding the EPL. Most of Chelsea’s player trading is with non-EPL clubs; this probably explains why the club could not rake in more transfer receipts. Normal service resumed in 2021/2022, though, as Chelsea funded its only signing’s (Lukaku) transfer fee of £104m entirely through the sale of players! No wonder Maria received the 2021 Ballon D’or equivalent award for European football club directors.

Debt

Chelsea’s total debt (excluding deferred income) in 2021 was £1.59bn, an increase of £41m from 2020. The bulk of the debt, £1.4bn, is a series of loans owed to Roman Abramovich. In 2021, Roman increased his funding of Chelsea via an additional £19.9m loan.

The loan tenures are not disclosed, but the financial statements reveal that the repayment of the short-term (£269m) and long-term loans (£1.13bn) require 3 and 18 months notice period, respectively. It is unlikely that the debt will be repaid any time soon. I believe it would only be settled if/when the club is sold to a new owner.

Conclusion

Chelsea’s operational model under Roman Abramovich has delivered yet another trophy, the most prestigious European title, the UCL, bringing the total haul to 19 trophies in 18 years. The success hasn’t come cheap; it has cost the oil-rich billionaire about £1.5bn. As I’ve pointed out in previous articles, the club has done well to adapt its business model to financial regulations such as UEFA’s FFP. From initial indications, the club is set to make player sale profit north of £100m in 2022, which, depending on other factors, might help the club report a profit or at least a significantly less loss in 2022. All thanks to the immense work of Maria Granovskaia. With a new stadium and focus on the commercial side of the business, Chelsea can reduce its reliance on player sales. One would say if it isn’t broken, why fix it right? Well, that’s what analysis is here for! The next frontier of success and possibility.