Analysis of Everton's 2020 financial statements

Global strategy, new stadium and the Director of Football role

Everton Football Club (Everton) released their 30th June 2020 year-end annual report on 11/12/2020. Despite reporting record losses, the Merseyside club seems to be on-track in its quest to disrupt the dominance of the so-called big-4 or big-6 by improving its global reputation. As expected, Covid-19 has negatively impacted the matchday revenue of the club.

Profit/(loss)

For a second consecutive year, Everton has reported a loss before taxation of over £100m (£140m in 2020). The 2020 negative EBITDA of £28m is more than five times the 2019 figure. The steep fall in profitability coincides with the 2018 arrival of Marcel Brands – the club’s Director of Football – and an ambition to improve on-field performances and become profitable! I discuss the Director of Football role later.

Revenue

With the evident financial success of Manchester United’s commercial approach, which began in 2013, English Premier League clubs are taking steps to be less reliant on broadcast revenue. Everton’s commercial revenue almost doubled within a year, and it now accounts for 41% of total revenue.

To achieve diversification of revenue, Everton employed several strategies: constructing a new stadium, purchasing young and continental talents, and increasing social media footprint. A first option on the naming rights for the 53,000-capacity stadium (due to be completed by 2024) fetched the club £30m. The signing of exciting and young South American and European players boosted global commercial partnerships. Of course, with the obsession by sponsors’ with social media interactions, Everton’s flamboyant and catchy unveiling videos for new signings are deliberate.

The excerpt below from club CEO Denise Barrett-Baxendale’s comments on the 2020 annual report highlights the club’s intention.

The signings are not just for commercial activities. It goes without saying that the signed players improve the playing squad, thereby increases the club’s chances of achieving on-field success. The new stadium is significantly bigger, and since fans are more likely to attend games when star players are playing, matchday revenue is set to improve. The average attendances have already improved ( about 1,000) and is reflected in the increase in matchday revenue.

Transfers and wages

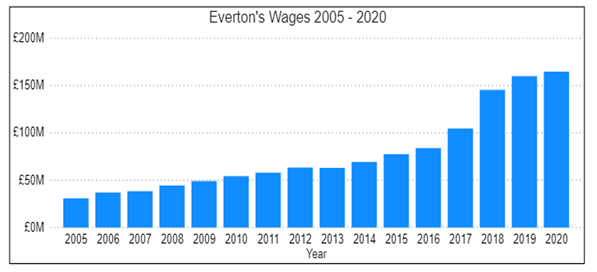

The signing of better quality and commercially-viable players is expensive and increases the total wage bill. In 2018, Everton broke the £100m ceiling of transfer fees paid, and the trend has continued.

The 2020 figures do not capture signings between July and September 2020 due to the June 2020 financial year cut-off. As such the £70m acquisition of Ben Godfrey, Allan, Doucoure and notably James Rodriquez in the summer is not included. This also applies to the club’s wage bill.

Once again, 2018 brought about a spike in the club’s wage bill. Nonetheless, compared to the clubs Everton is looking to leap-frog in the EPL, its wage bill is in good shape.

In contrast, Everton’s 2020 wage-to-revenue figure of 89% (85% in 2019) is expected to exceed that of the clubs once again it wants to compete with ( 2019:Spurs 39%, Arsenal 60%, Manutd 53%, Chelsea 64%, and Leicester City 84%).

Of course, once on-field performances and off-field commercial endeavours improve, the percentage would reduce. The club’s ambition is clear, risky and requires quick results. Marcos Silva, sacked after winning just four out of 13 games in the 2019/2020 season, would be the first to mention how slim the margin for error is.

Debt

Everton’s debt – especially short-term debt - has increased significantly, and this is due to the club’s ambition. Of the £158m short-term debt, £93m relates to money owed to other clubs regarding player transfers. The club has interest-bearing loans of £58m due to be paid within one year and are secured with future broadcast revenue and receivables from player sales.

The club’s cash flow is positive in 2020, and the increased commercial revenue is responsible. Nevertheless, Everton has renewed a revolving credit facility (RCF) of £80m which it can draw if required. The RCF, commercial and broadcast revenue and the club’s majority shareholder’s commitment to supporting the club provide comfort over the club’s continued existence for at least 12 months – even if fans are not allowed into stadiums for the entire season due to Covid-19. See excerpt from 2020 annual accounts for Everton’s Directors going-concern assessment below.

Director of Football

Everton operates a management structure which includes the Director of Football (DoF) position. The role of DoF differs from club to club and depends on the owner’s vision. There are DoFs whose job is to organise the entire footballing aspect of the club (tactical philosophy and playing-style, image-building and recruitment) and DoFs who stick to only recruitment. Marcel Brands fits into the first description.

Before his appointment in 2018, Steve Walsh held the position, even though his scope of work was not as expansive Marcel’s. This is exemplified by the fact that Marcel has two-pages in the annual report (see excerpt below) where he documents the club’s progress and plans as it pertains to signings, playing style, and a bit of tactics.

This did not happen under Steve. Marcel’s role is central to the club’s quest for success. No wonder, 2018, the year of his appointment, coincided with improved commercial activity, player recruitment and global image building.

Conclusion

There are several moving parts to achieve on-field success; recruitment, facilities, tactics, medical department, the Manager and squad cohesion. Without a doubt, Everton has taken steps in the right direction to ensure they break into the top 6. The signing of top stars like James Rodriguez and Carlos Ancelotti’s appointment – he has won 20 trophies including three UEFA Champions Leagues – is Everton throwing down the gauntlet. Time would tell if their investment and strategies pay-off.

Your comments like and shares are appreciated!