Part Two: EPL Season Closes, Time to Focus on Finances

Top Six Clubs and the "new" kid on the block, Newcastle United

Introduction

In the first part of this series, I analysed the traditional top six clubs (Arsenal, Manchester United, Manchester City, Liverpool, Chelsea and Tottenham) and Newcastle United’s 2022 financial performance (which covers the 2021/2022 season). Specifically, I used UEFA’s Squad Cost Ratio (SCR) as a framework — I discussed the SCR numerator (SCRN), SCR denominator (SCRD) and SCR percentage. In the final part of this series, I analyse the clubs 2022/2023 on-field performance and provide an outlook for each club going forward. Please note that the clubs’ 2023 financial results (covering the 2022/2023 season) would typically be released between October 2023 and April 2024.

2022/2023 Season and European Qualification

The impact of a club’s on-field performance on its financial performance is seen in the SCRN, SCRD and SCR % discussed in part one of this series. The table below shows the position of each club in the 2021/2022 and 2022/2023 seasons and what European competition they’d play in for the 2023/2024 season.

Newcastle United was the biggest mover on the EPL table, climbing seven places to fourth position, meaning the club would be competing in the UEFA Champions League (UCL) for the 2023/2024 season. Newcastle United’s last appearance in Europe was in 2012. Manchester United and Arsenal both moved up three places to second and third place respectively, with both clubs returning to the UCL – this is the first time in six seasons that Arsenal would be appearing in the UCL.

Chelsea fell by nine places to twelfth position, confirming that the club would not play in any European competition for the first time in seven years. Similarly, Tottenham’s eighth position, four positions down from the 2021/2022 season means the club would not play in Europe for the first time in fourteen years. Liverpool would play in the UEFA Europa League (UEL) for the first time in seven years, following six straight UCL appearances. Manchester City would play in the UCL for the thirteenth straight season.

The financial impact of the clubs' final position in the EPL can be seen in the image below which represents the broadcast distribution for the 2021/2022 season. The exact amount that each club would earn for the 2022/2023 season might slightly differ from the figures below.

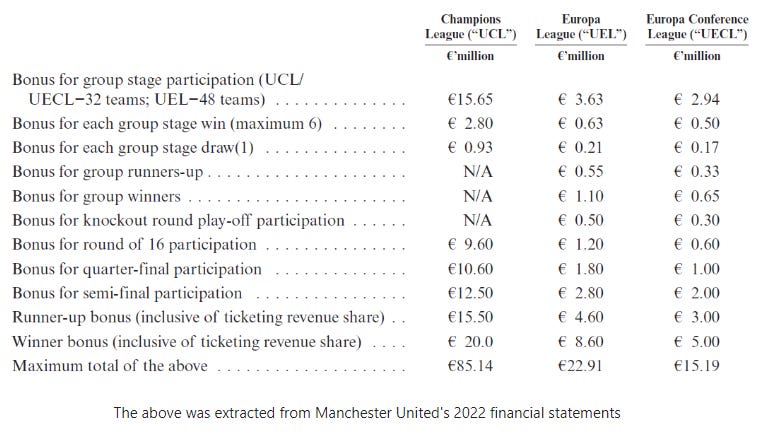

The broadcast revenue for participating in European football can be seen in the image below. In addition, clubs receive fixed distribution based on the UEFA coefficient ranking. The fixed distribution for the UCL, UEL and UECL for the 2023/2024 season are €1.1bn, €226m, and €188m respectively.

Based on all that has been presented and discussed above and in part one, the following sections are an outlook for each club.

Manchester City

Manchester City is on-course to retain its spot as the number one club globally for revenue earned because they have retained their EPL title and are in the UCL final for the 2022/2023 season. As long as Manchester City can maintain its good record of moving players on at the right time and earning a healthy profit, its SCR would continue to grow. However, the club would need to improve its MRSA to ensure stable revenue given that it might be difficult to win the EPL and constantly reach the latter stages of the UCL (or maybe they could?). Also, Manchester City would need to keep an eye on its wage bill which is currently £354m.

Arsenal

Arsenal’s return to the UCL and its strong second-place finish in the EPL would significantly improve the club’s broadcast revenue and MRSA. An area of improvement for the club is in its commercial revenue which at £142m is the lowest of the top-six clubs. The UCL return can be used as a bargaining chip when selling the club’s brand to sponsorship and advertising partners. Also, Arsenal should maintain (probably improve) the trend of selling players at the right time and price. With a moderately sized wage bill, Arsenal has wiggle room to bring in more players, but the club must do better at negotiating transfers with their annual transfer fee at £125m. With the right balance, Arsenal can improve its current 84% SCR position and equally position itself for more on-field success.

Manchester United

Manchester United’s broadcast revenue and MRSA would improve if the club can progress to the latter stages of the UCL. With the highest stadium capacity in the EPL, Manchester United consistently playing in the UCL and reaching its latter stages would see its MRSA top the charts. However, if the club embarks on major stadium improvements (as rumoured), it would benefit from this long term while suffering in the short term from reduced capacity. Unlike London-based clubs, Manchester United does not have the luxury of playing their games at Wembley (or maybe share with Manchester City like Inter and AC Milan? Or close one stand like Real Madrid?). This would need careful consideration from the club’s decision-makers. Also, the club would need to keep an eye on its wage bill but the termination of Cristiano Ronaldo’s contract and David De Gea renegotiating on rumoured reduced terms would help balance the club’s books. Most importantly, Manchester United has to improve its ability to sell players for profit. Famous for having one of the most productive academies in the world, the club could make a healthy profit by selling academy players that it deems would not make it at the club. The total transfer fee for these players would represent pure profit for the club. An example of this was when the club sold James Garner – who hadn’t broken into the first team – to Everton for £15m. Similarly, Manchester United’s commercial revenue can do with improved on-field success to help the club maximise its brand value with sponsorship partners. The club needs to improve all these aspects to ensure that their SCR reduces from 90%.

Liverpool

Like Manchester City, Liverpool's impressive on-field success has helped the club maintain a healthy SCR. However, reduced revenue from dropping out of the UCL to the UEL would negatively impact the club’s SCR position which is currently 75%. Furthermore, the club’s wage bill of £366m is the second highest in the EPL and might need trimming. With reduced revenue, Liverpool is faced with the difficulty of balancing investing to improve their on-field performances and maintain a healthy financial position. Selling some of the club’s players that might not be used within the squad and can generate healthy profit can help the club achieve its financial objectives.

Chelsea

Chelsea’s absence from European football, and significant transfer activity (I wrote about this here) in the preceding two windows would worsen the club’s 87% SCR. To mitigate this, Chelsea would need to ensure their record of selling players for healthy profit continues. Also, this could improve their wage bill which stands at £354m. Chelsea is rumoured to be about to begin plans to expand the current stadium or build another which would, in the long term, improve its MRSA. If true, the club can follow in Tottenham’s footsteps and play its home games at the Wembley Stadium which is located in the same city.

Tottenham

Absence from Europe would likely increase Tottenham’s SCR of 63%, though the club’s lean wage bill would cushion the impact. Also, Tottenham’s multifunctional stadium and recent fifteen-year electric karting deal with Formula One would further help to cushion the impact of the lost revenue. Importantly, Tottenham has to improve its ability to sell players for a profit with its relatively low current figure of £18m. The rumoured sale of Tottenham’s record goal scorer, Harry Kane for north of £80m, would help improve the club’s SCR but might negatively impact on-field performance.

Newcastle United

Newcastle United seem to be the biggest winner in the current EPL season and has an exciting future ahead. First, with annual transfer fees of £51m and £170m wage bill, the club has not had to break the bank to earn a UCL spot. The windfall of revenue would improve Newcastle United's SCR which currently stands at 116%. Also, Newcastle United’s £27m commercial revenue would significantly improve – the club is negotiating a shirt sponsorship worth £25m per season which is almost 100% of its current total commercial revenue. The club must maintain its data-driven recruitment which seems to mirror Manchester City’s policy of recruiting high-potential players in the 20-25 years age bracket.

Conclusion

The above shows how clubs must balance their desire for on-field success and financial considerations. Investments don’t always realise returns as expected. However, with the fierce competition for on-field success, clubs must carry out extensive due-diligence, whether it is in player recruitment, stadium upgrade, data analytics or off-field football executive personnel. Sometimes, good old luck plays a part in addition to due diligence Newcastle United’s emergence, Manchester United and Arsenal’s resurgence, Liverpool and Tottenham’s subpar performances, and Manchester City’s quest to remain at the top means the 2023/2024 season would produce yet another breathe-taking EPL season.

"Kindly note that the financial information used in this article were hand-collected and analysed by the author from the clubs’ publicly available financial statements”